The objective of the MS in Financial Engineering program is the training of graduate students with engineering, applied mathematics or physics backgrounds in the application of mathematical and engineering tools to finance.

This multidisciplinary education program involves the Viterbi School of Engineering, the Marshall School of Business and the College of Letters, Arts and Sciences (Department of Economics). Financial engineering uses tools from finance and economics, engineering, applied mathematics, and statistics to address problems such as derivative securities valuation, strategic planning and dynamic investment strategies, risk management, etc. Graduates with these skills are of interest to investment and commercial banks, trading companies, hedge funds, insurance companies, corporate risk managers, and regulatory agencies etc.

International Students: This program is eligible for the OPT STEM extension.

- This program requires completion of 33 units of coursework

- Thesis option and Directed Research (research without thesis) may be requested after completing first semester. Thesis option is not guaranteed

- USC Catalogue

- USC Schedule of Classes

APPLICATION DEADLINES

| SEMESTER | DEADLINE |

| Spring | September 1 (extended to October 1) |

| Fall | December 15 (Scholarship consideration)

January 15 (Final deadline) |

Visit our Ready to Apply page for more information

ELIGIBILITY CRITERIA

Applicants to the master's of science programs in Financial Engineering are required to have a bachelor’s degree or be in the process of completing a bachelor's degree. Degrees in any engineering or engineering-related disciplines are frequently represented among our program applicants, including but not limited to the following:

- Computer Science

- Biomedical Engineering

- Economics

- Electrical Engineering

- Finance

- Industrial & Systems Engineering

Applicants without a Bachelor’s degree in the preferred majors listed above will only be considered with coursework and demonstrated proficiency in the acceptable courses listed below (or equivalent).

|

| Calculus 1-3 |

| Differential Equations |

| Linear Algebra |

| Probability/Statistics |

Applications are reviewed holistically; simply taking these courses does not guarantee admission.

APPLICATION REQUIREMENTS

The following materials are required to be included with your online application:

- Transcripts

- Resume/CV

- Personal Statement

- Letter of Recommendation (Optional)

NOTE: The GRE is not required for 2026 applications.

The following link will take you to an overview of the tuition & fees for graduate engineering students, including payment information. Both on-campus and DEN@Viterbi students pay the same tuition

TUITION AND FEES OVERVIEW

Use the link below to download the Cost of Attendance to see a summary of tuition and fees by semester. The document is a typical example and the number of courses, and time to complete the program, will vary by student.

Estimated Cost of Attendance - 33 Unit Program

JIAQI LAI

JIAQI LAI

What were the main reasons you chose to pursue this graduate program at USC?

I chose the MFE program at USC because I am interested in learning more technical skills to be applied in the financial industry. MFE’s curriculum is a combination of Math, Stats and Engineering, which was really appealing to me. I liked the variety of elective courses from the Viterbi School of Engineering and Marshall School of Business that this program offers.

What are some personal achievements or experiences you’d like to share?

1. I wrote my first-ever research paper, which studied using PCA to do asset allocation

2. I accepted a full-time offer as an actuarial assistant after graduation

3. I received the Outstanding Mentoring Award from the Viterbi School

Which organizations/activities have you been involved with outside of the classroom?

I was a mentor for 3 semesters at USC under the Viterbi Graduate Mentorship Program. Also attended many of the events hosted by the Viterbi Graduate Student Association.

What advice would you give future Viterbi School students?

Explore and utilizes as many as resources you can at USC. Some experiences can be life-changing for you. Proactively communicate with faculty, staff, and peers. Don’t be shy and speak up. Go forth, and blossom!

YEN SEE CHEN

YEN SEE CHEN

What were the main reasons you chose to pursue this graduate program at USC?

I have always had my passion to do better and to help others live better. When I was working as a financial analyst, I found that there were topics that had not been covered by professors at school which made me want to find solutions so I can serve my clients better. Even though I passed all three levels of the CFA test, the problems are still there. In 2021, I researched to see if I could find a program that combines finance, math, and technology and here it is-master in financial engineering. USC has been the pioneer of online learning. The way that USC combines top-notch professors and the opportunity for online learning made this program become the goal of my life.

Tell us about an exciting and unforgettable experience from your time so far at USC.

Even though I have been taking courses online, I can still engage with my professors and TAs just as the other students on campus. The thorough lectures and patience of the faculty are the reasons that I keep highly motivated in every class. I also have access to the USC library, which is my favorite part of being a remote USC student because I can research all kinds of topics in my own house or office. How comfortable is that?

.

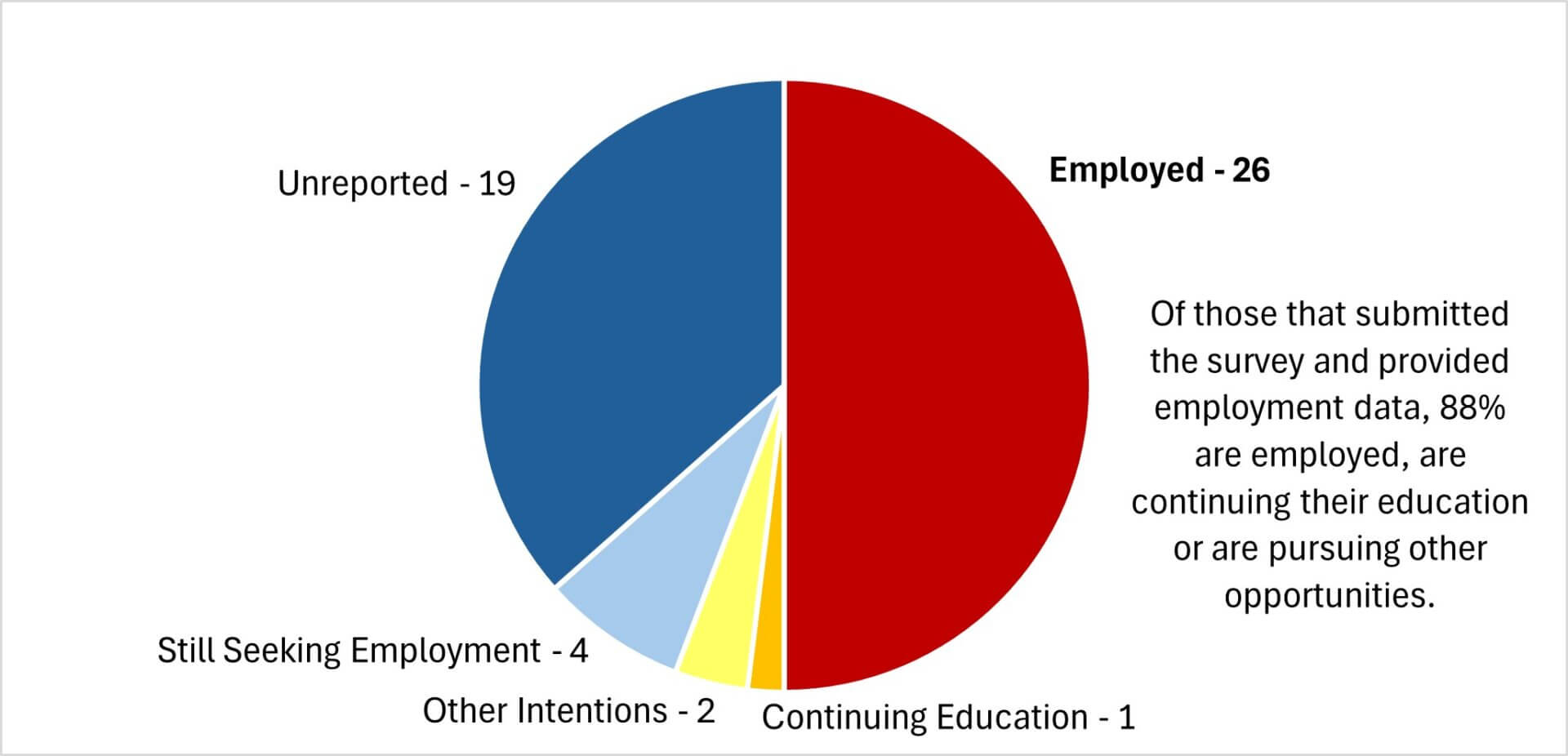

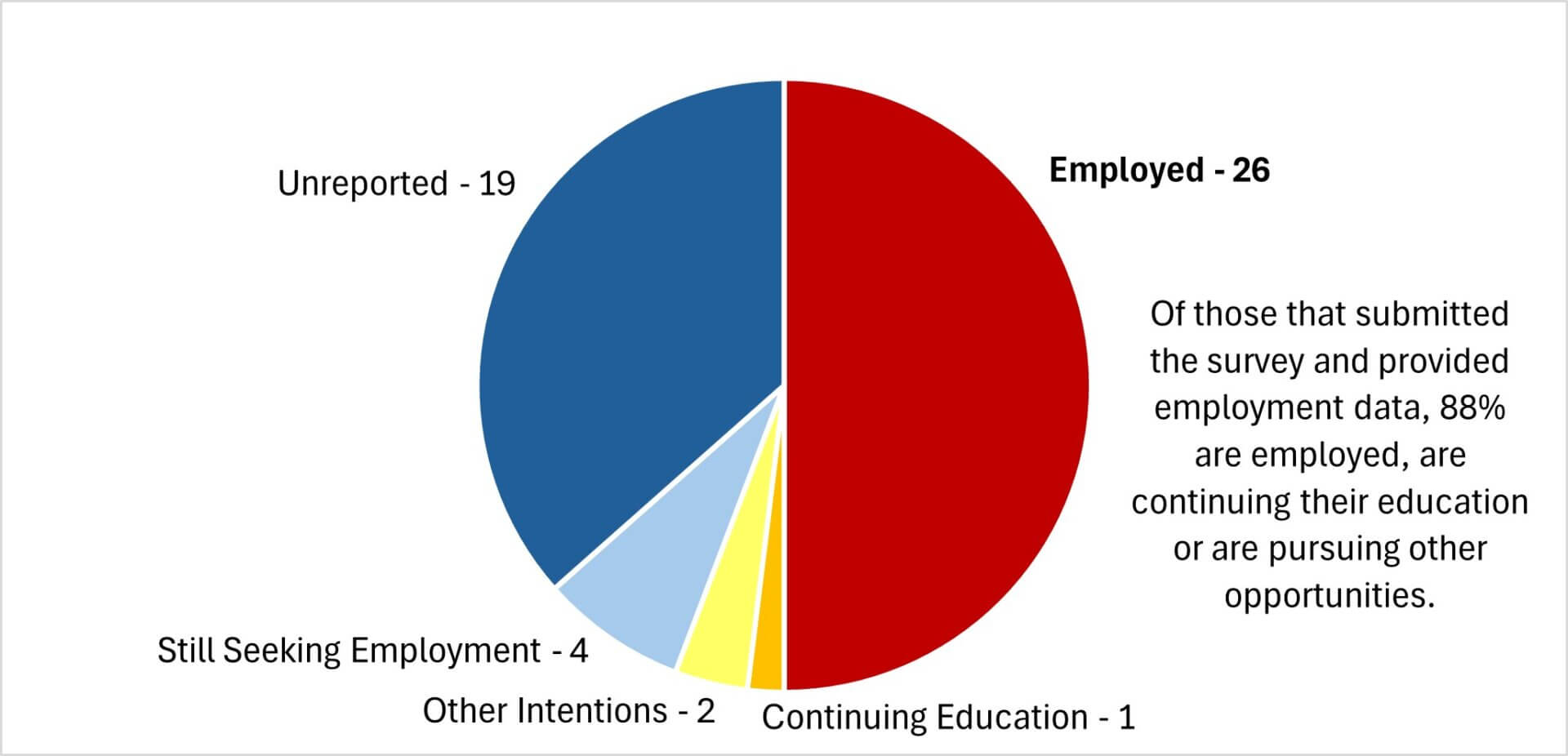

2024 First Destinations Survey - Outcomes*

.Alumni Employment - 2024*

Companies & Job Titles (multiple positions may be listed)

Average Reported Salary: $88,000

- AVIC Securities - Fixed Income Trader

- Bardi Co. - Investment Banking Analyst intern

- BeaconFire Solution, Inc. - Mern/Mean Full Stack Developer

- CBRE - Financial Analyst

- Continental Hydraulics, Inc. - Financial Data Analyst

- Easley-Dunn Productions, Inc. - Economy Developer

- Epione Medical Corporation - Accounting Intern

- Ey Consulting Firm - Risk Advisory Associates

- GE Healthcare - QRLP

- Goldman Sachs - Controllers Analyst

- Guggenheim Partners - Investment Analyst

- Guolian Securities - Wealth Management

- HireBeat, Inc. - Financial Analyst Intern

- InProcess Design Studio - Co-Founder

- Jet Midwest - Financial Analyst

- Knight Management Insurance Services LLC - Staff Accountant

- Moo Housing, Inc. - Accounting Assistant

- New York Life - Insurance Assistant

- Pinnacle Education Technology LLC - Business Analyst Intern

- TPS Thayer - Staff Audit Associate

- United States Air Force - Software Engineer

- WorldQuant LLC - Quantitative Research Consultant

Past Years

- Abbott Laboratories - Financial Analyst

- Alvarez Marsal - Analyst Restructuring Turnaround

- Amazon - Software Development Engineer

- Amazon Web Services - Software Development Engineer

- AmeriHome Mortgage Company LLC - Financial Engineer

- Aprio - Business Valuation Associate

- Capital One - Senior Quantitative Analyst

- Citic Securities Company Limited - Senior Associate

- EY - Associate Financial Consultant

- Global Atlantic Financial Company - Investment Analysis

- Goldman Sachs - Senior Analyst

- Griffinest Asia Securities LLC - Research Analyst

- Heritage Provider Network - Software Development Engineer

- Huntington National Bank - Model Risk Review Specialist

- Hyundai Capital America - Associate

- J.P. Morgan Chase & Co. - Financial Analyst

- JoblogicX Corporation - Data Scientist intern

- Knight Insurance Group - Data Analyst

- MeetData LLC - Data Analyst

- Meituan - Strategy Investment Professional

- Meta Platforms, Inc. - Data Engineer, Production Engineer

- Moody's Analytics - Product Specialist

- Penghua Fund Management Co., Ltd. - Marketing Operations

- Quantum Photonics Club Corp. - Digital Marketing Analyst

- Starlight Media, Inc. - Financial Analyst

- Tencent - Product Manager

- The Aerospace Corporation - Senior Project Engineer

- Voya Financial - Actuarial Assistant

- ZS - Decision Analytics Associate

.Internships (Summer 2023)**

CBRE, CLSA, Dowell Holding Group

.

* Information is based on a voluntary survey and should not be interpreted as a comprehensive view of the 2024 graduating class.

** Internship data is from CPT internships done by our international student population.

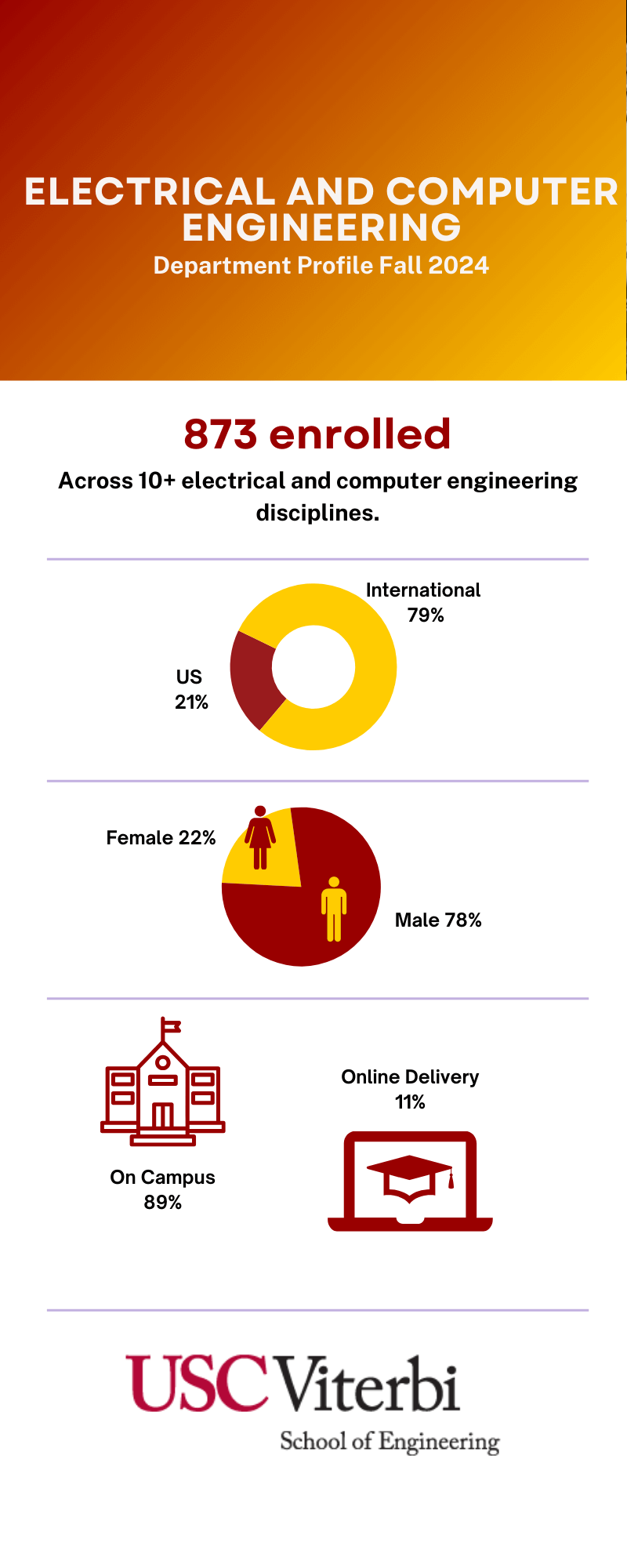

This program is also available online to professional engineers through DEN@Viterbi. Because the DEN@Viterbi program provides a fully equivalent academic experience, the degree a USC engineering student earns is the same whether they are on-campus or online.

If you are interested in beginning classes as a DEN@Viterbi student next semester, explore the requirements and steps to enrolling as a Limited Status Student.

Learn More About DEN@Viterbi

Detailed Program Curriculum and RequirementsSchedule of Classes

DEN@VITERBI ONLINE COURSE OFFERINGS

The following courses and program requirements serve as program planning for DEN@Viterbi students. Course offerings and availability are subject to change. Please consult with advisor if you have any questions.

| Required Courses |

| All Courses Required - 20-21 units total. |

| GSBA 548 | Corporate Finance (3 units)* |

| ISE 563 | Financial Engineering (4 units) |

| EE 503 | Probability for Electrical and Computer Engineers (4 units) |

| EE 512 | Stochastic Processes (4 units) |

| EE 518 | Mathematics and Tools for Financial Engineering (4 units) |

| EE 590 | Directed Research (1 unit required; maximum 2 units) |

| Do NOT register for the 2-unit version of GSBA 548. |

Elective Courses (Adviser-Approved)

|

| Finance, Business, and Economics Area |

Three courses required - at least 9 units.

|

| FBE 543 | Forecasting and Risk Analysis (3 units) |

| FBE 555 | Investment Analysis and Portfolio Management (3 units) |

Contact adviser for more elective course options.

|

| Optimization, Simulations, and Stochastic Systems Area |

One course required.

|

| CSCI 567 | Machine Learning (4 units) |

| DSCI 552 | Machine Learning for Data Science (4 units) |

| ISE 529 | Predictive Analytics (4 units) |

| Students may take CSCI 567 OR DSCI 552 OR ISE 529. |

Please complete the following form for more information.

JIAQI LAI

JIAQI LAI YEN SEE CHEN

YEN SEE CHEN